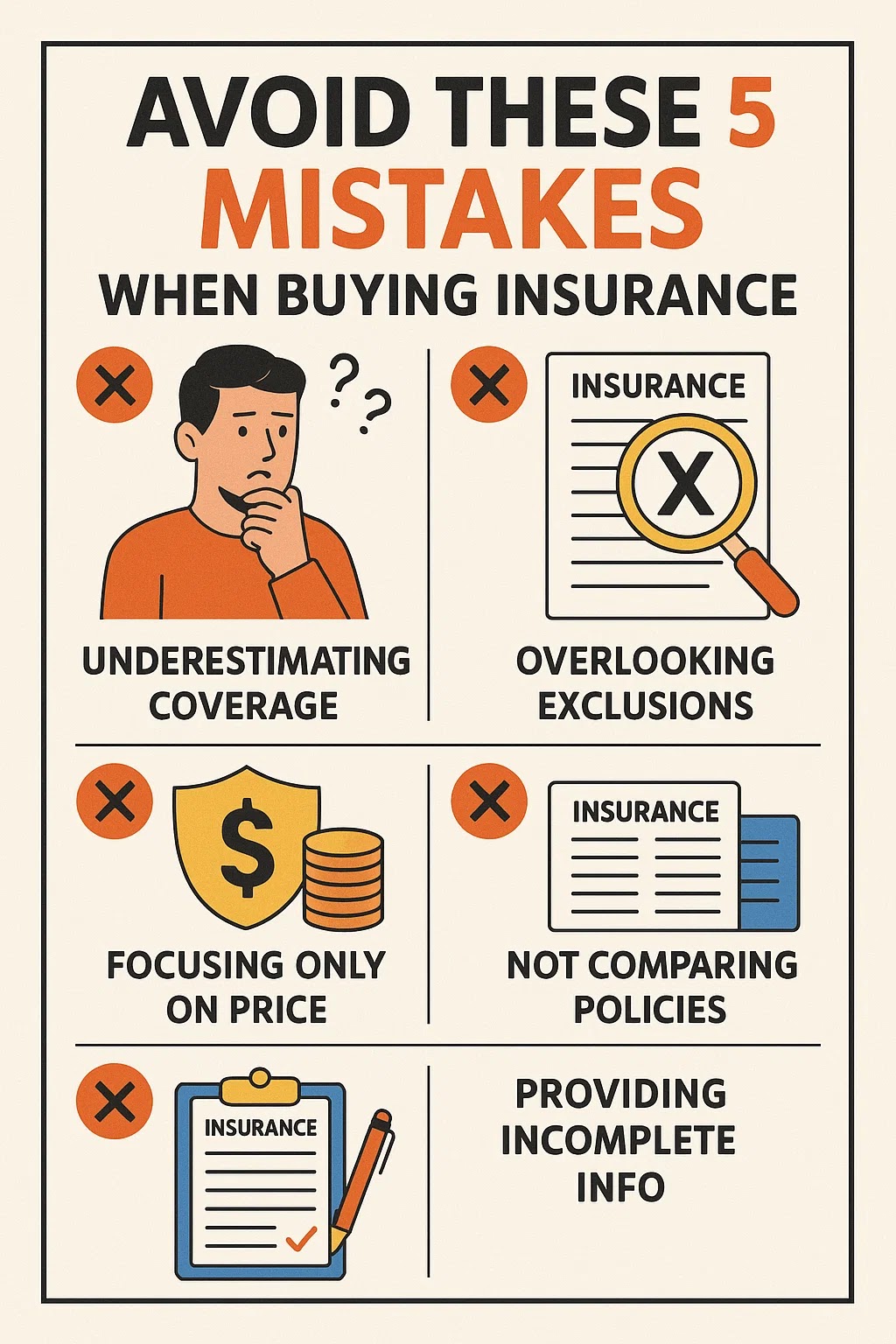

Buying insurance is an important step

in financial planning. However, many people still make mistakes when choosing

an insurance product. Mistakes when buying insurance can have fatal

consequences, both financially and in terms of the protection you receive. In

this article, we discuss five common mistakes that often occur when purchasing

insurance and how to avoid them so you can get the best insurance that suits

your needs.

1. Not understanding

your insurance needs

One of the most common mistakes is not

understanding your own insurance needs. Many people buy insurance simply

because others do it too or because they are attracted by appealing

advertisements. Before purchasing insurance, it is important to conduct a needs

analysis. Ask yourself: what do you want to protect? Is it health, life, or

belongings? By understanding your needs, you can choose the most suitable

insurance product.

Tip:

- Create

a list of the belongings and risks you want to protect.

- Discuss

it with a financial advisor or insurance agent to get the right advice.

2. Not comparing

insurance products

Another common mistake is not comparing

different products available in the market. Each insurance company offers

different products with various benefits and varying premiums. If you focus

solely on one product, you may miss out on the best insurance that better fits

your needs and budget.

Tip:

- Use

insurance comparison websites to view different options.

- Don't

hesitate to request quotes from multiple insurance companies before making

a decision.

3. Ignoring the terms

and conditions

Many people rush to buy insurance

without reading the applicable terms. This is a very dangerous mistake as it

can lead to long-term dissatisfaction. Make sure you understand all the terms,

including exclusions and limitations in the insurance contract.

- Take

the time to thoroughly read the policy document.

- Ask

your insurance agent if there is anything you do not understand.

4. Not paying

attention to premium and benefits

Another common mistake is ignoring the

relationship between the premium and the benefits offered. Many people get

stuck on a low premium without considering the benefits received. On the other

hand, some choose products with a high premium without understanding whether

the benefits are proportional to the costs incurred.

Tip:

- Compare

the premium with the benefits offered.

- Ensure

that you get the best value for your money.

5. Ignoring the

reviews and reputation of the insurance company

Finally, a frequently overlooked

mistake is ignoring the reputation of the insurance company. Choosing a

reliable insurance company with positive reviews is crucial to ensuring that

your claims are handled properly. Do not choose based solely on advertisements

or recommendations without doing your research.

Tip:

- Look

for reviews and ratings of insurance companies on independent websites.

- Ask

friends or family about their experiences with a particular insurance

company.

Conclusion

Buying insurance is a significant

decision that requires careful consideration. Avoid these 5 mistakes when

purchasing insurance so you can choose a product that truly meets your needs.

By understanding your needs, comparing products, reading the terms and

conditions, paying attention to premium and benefits, and selecting a

highly-rated insurance company, you can ensure that you get the best insurance.

Remember that investing in insurance is not just about protecting yourself, but

also about creating a sense of security for your future and that of the people

you love.